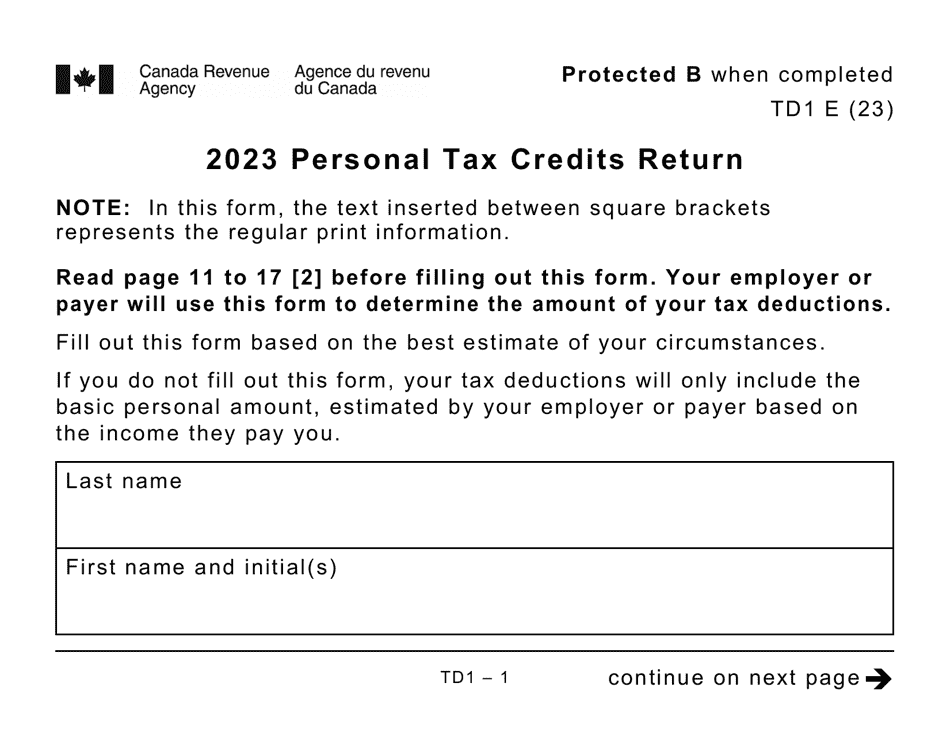

2025 Personal Tax Credits Return Bc. 2025 personal tax credits return. Plug in a few numbers and we’ll give you visibility into your tax bracket, marginal tax rate, average tax rate, and payroll tax deductions, along with an estimate of your tax refunds and taxes owed.

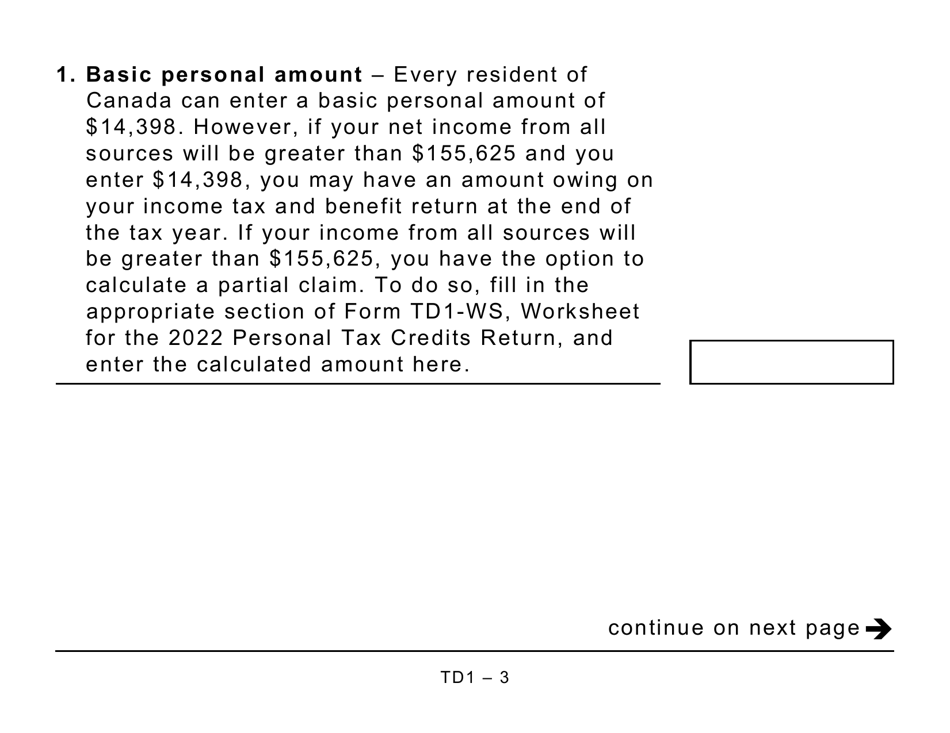

Basic tax credits are calculated by multiplying the base amount. Whether you’re managing your 2025 personal tax credits or seeking help from a personal income tax accountant, this guide will simplify the process for you.

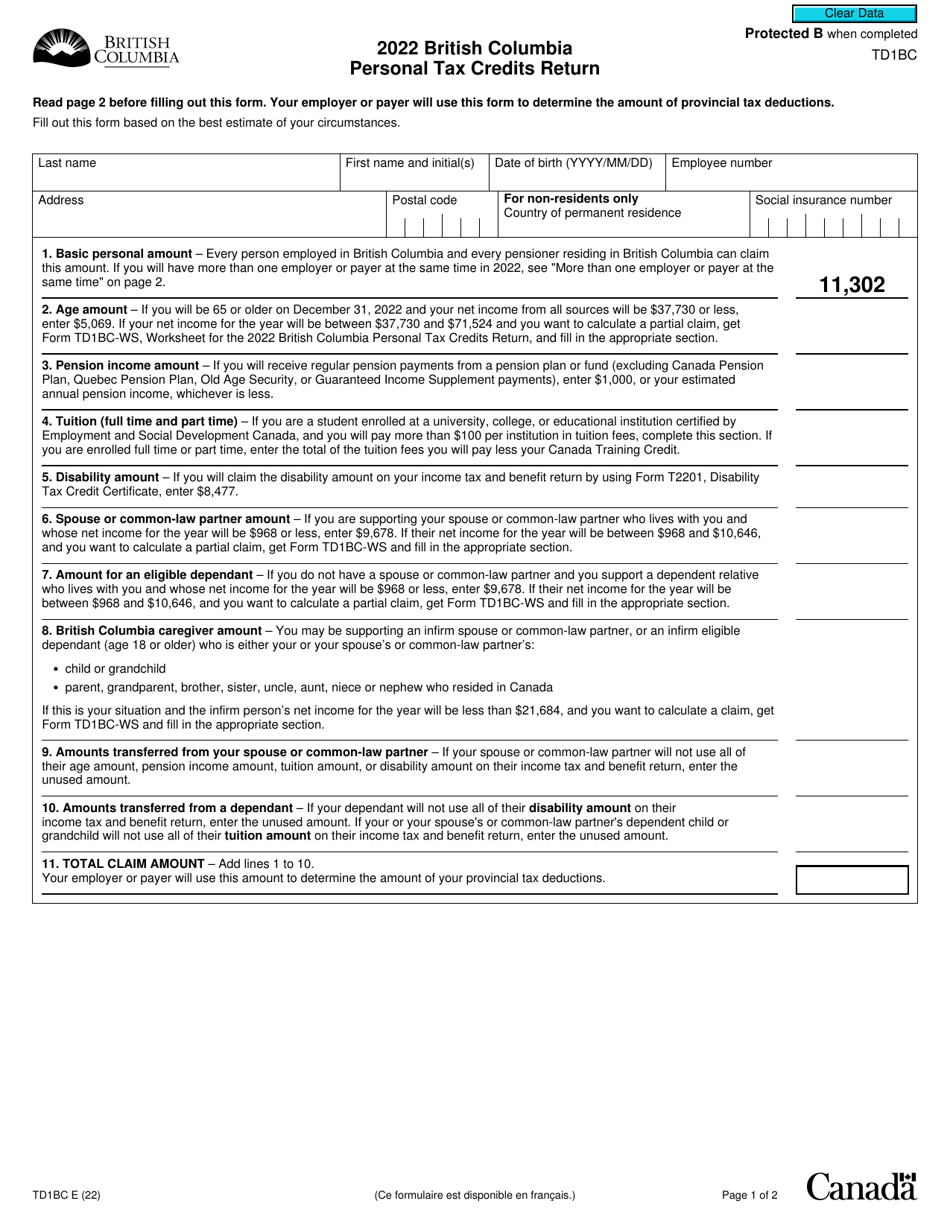

2025 Personal Tax Credits Return Bc Heddi Rowena, Employer/ payer uses the td1 personal tax credit return to determine the amount of income taxes to be deducted from employment income or other income.

Cra 2025 Personal Tax Credits Return Form Mella Siobhan, Read page 2 before filling out this form.

2025 Personal Tax Credits Return Bc Heddi Rowena, Your employer or payer will use this form to determine the amount of your tax deductions.

Fillable Online 2025 Personal Tax Credits Return Fax Email Print pdfFiller, Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn anywhere from $8,481 to $21,885, depending on the province or territory.

2025 Personal Tax Credits Return Bc Heddi Rowena, Tax credits can be based on income, investments, training or.

How To Fill TD1 2025 Personal Tax Credits Return Form Federal YouTube, Your employer or payer will use this form to determine the amount of your tax deductions.

Canada Tax Forms 2025 Tiffi, The bc tax brackets and personal tax credit amounts are increased for 2025 by an.

Canada 2025 Personal Tax Credits Return Amelie Malvina, Bc tax credits reduce your income tax liability and maximize your savings.